WoodGreen operates year-round tax clinics for low-income individuals and households. The tax clinic assists with preparation of simple tax returns, up to 10 years of back taxes and T1 adjustments. We also support with Notices of Assessment, responses to CRA letters and other tax related matters.

Quick facts

Program description

Eligibility requirements

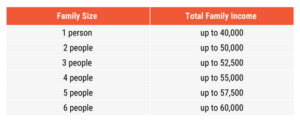

Income eligibility:

For larger families, add $2,500 to each additional person to determine the limit.

Please note, we are unable to assist individuals who:

- Filed for bankruptcy

- Have rental or business income to report

- Have capital gains or losses to report

- Have investment income of more than $1,000 per year

- Need to prepare a return for a deceased person

- Have self-employment income/deductions to claim

Need help with self-employed taxes? Click Here to see our Tax Skills for Self Employed Workers program.

Before your appointment, please have the following documents and information readily available:

All clients:

- Social Insurance Number (SIN) and spouse’s SIN (if applicable). (Note: If married/common-law, both you AND your spouse must attend the appointment if you both plan to file a tax return. We can only assist in filing tax returns for people who are not present if you have proof that you have Power of Attorney).

- Income slips from all your income sources (e.g., T4 slip for employment, T5007 slip for OW or ODSP). If you do not have these slips, you can request new copies by calling the CRA at 1-800-959-8281.

If you rent your residence:

A receipt or letter from your landlord that states:

- Your name

- Landlord’s name and contact information

- Address of the place you are renting

- Number of months you have lived at this address

- Amount of rent you paid during the year

*You cannot claim your rent in your tax return without this letter/receipt.

If you own your own home:

- Your property tax bill from the City of Toronto (or another municipality in Ontario)

*You cannot claim your property tax in your tax return without this bill.

If you were new to Canada in the tax year you are filing:

- Exact date of arrival in Canada

- Total income earned in the year prior to arriving in Canada

If you have children in your custody:

- Names and dates of birth for any children under age 19

- Receipts for child care expenses (must include caregiver’s SIN)

If you are a student (post-secondary):

- Receipt for tuition fees (T2202A form — usually accessed through your online student account)

- OSAP loans do not count as income and do not need to be claimed in your tax return

- Interest slip/receipt for interest paid on your OSAP loan

If you have deductions to claim:

- For clients 65+, Transit/TTC passes (you must have actual passes or PRESTO Usage Report)

- Medical expense receipts

- Charitable or political donation receipts

PLEASE NOTE: You may require additional documentation for your tax return. Contact us for guidance on how to obtain missing paperwork.

Program testimonials

Anonymous

Client

Ready to participate?

Register and receive FREE support from our Tax Clinic

Book an appointmentNeed help?

Contact information

Location

815 Danforth Ave - 3rd floor

Toronto, ON

M4J 1L2

Hours

Appointments are available Monday – Friday: 9 a.m. – 5 p.m.

Partners